Choosing the right card machine UK businesses can trust is crucial in 2026. Whether you’re running a café in Manchester, a salon in Belfast, or a food truck on the move, your card machine UK solution directly impacts customer experience and cash flow.

The challenge? Countless providers, confusing pricing, and the big question: who actually understands small business needs?

Enter NPI—a trusted payment solutions provider combining world-class technology with genuinely local support available 7 days a week. NPI delivers technical support until 8:30 PM weekdays and 8 PM weekends—real people who understand your business challenges.

What Your Card Machine UK Should Deliver

Before diving into specific terminals, let’s clarify what matters:

Speed & Reliability: Instant processing, every time. When customers are queuing, every second counts.

Flexibility: Mobile or countertop—solutions that fit your operation, whether you’re tableside, behind the counter, or on the road.

Transparent Pricing: No hidden fees eating your margins. You need to know exactly what you’re paying.

Real Support: Actual people locally based, not call center mazes or chatbots that don’t understand your urgency.

Scalability: Systems that grow with your business—from one terminal to multi-location EPOS solutions.

Best Card Machine UK Options from NPI

Castle S1 MINI2 – Power in Your Pocket

Perfect for: Taxi drivers, market stalls, food trucks, mobile services

The S1 MINI2 weighs just 155g but packs serious capability. Its 2000mAh battery lasts all day, eliminating mid-shift charging anxiety. Contactless NFC payments process instantly, while Bluetooth 4.2 and WiFi ensure reliable connectivity wherever you work.

Pricing: From £11/month (18-month rental), £12.50/month (12-month), or £79 outright Why choose it: True portability with professional features. Front camera for data capture, ergonomic grip for long shifts.

PAX A50 – Smart MiniPOS

Perfect for: Restaurants, cafés, salons, versatile businesses

This feels like using a smartphone to accept payments. The 4.5″ touchscreen (720 x 1280 pixels) makes navigation intuitive, while Android-based operation means familiar interface. Built-in 4G connectivity ensures you’re never offline, and the 2500mAh battery handles busy service days.

Pricing: From £15/month (18-month rental), £17/month (12-month) Why choose it: Bridges mobility and functionality. Light enough (161g) for tableside service, powerful enough for all-day operation. Email receipts directly to customers.

PAX A35 – Professional Pinpad

Perfect for: Retail stores, pharmacies, beauty shops, flower shops

Your reliable countertop workhorse. The A35 connects via Ethernet or WiFi, processes transactions in seconds, and handles everything from contactless taps to chip-and-PIN to magstripe. Its compact footprint (160mm x 80mm x 56mm) saves precious counter space.

Pricing: From £17/month (18-month rental), £18.50/month (12-month) Why choose it: Dependable daily performance. PCI PTS 5.x security certified, supports email receipts, built to handle high-traffic environments.

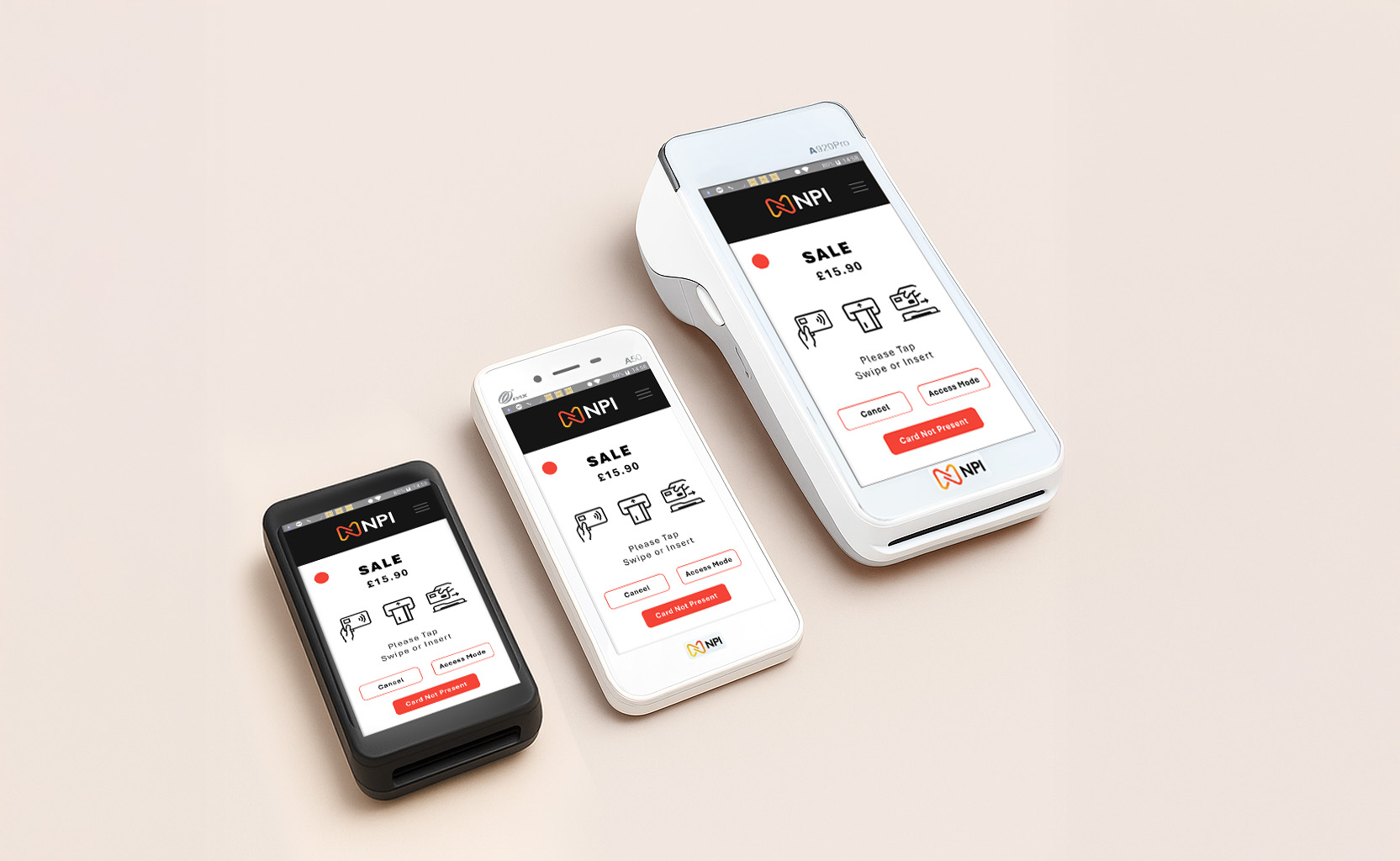

PAX A920PRO – The Complete Solution

Perfect for: Restaurants, pubs, hotels, multi-location businesses

This changes the game for hospitality. The 5″ HD screen provides excellent visibility, while the built-in 80mm thermal printer eliminates separate receipt hardware. Quad-core processor handles complex operations smoothly, and 4G LTE means it works anywhere.

Pricing (volume discounts available):

- Less than 10 terminals: From £20/month

- 11-25 terminals: From £19.25/month

- 26-50 terminals: From £18.50/month

- 51+ terminals: From £17.75/month

Why choose it: All-in-one efficiency. Print kitchen orders while processing payment. EPOS integration ready. Scales beautifully with volume pricing.

SUNMI KIOSK K2 – Self-Service Future

Perfect for: Fast-casual restaurants, cafés, takeaways

The 21.5″ Full HD touchscreen transforms customer ordering. Integrated thermal printer provides instant receipts. Android-based system allows easy app integration and customization. Floor-standing or wall-mounted installation options fit any space.

Why choose it: Reduce queues, increase order values (self-service customers add more items), free up staff for hospitality. Next-day settlement gets you paid quickly.

Card Machine UK Pricing: Transparent & Competitive

NPI’s card machine UK pricing is refreshingly straightforward. Here’s exactly what you’ll pay:

Card Present Transactions (UK):

- Personal Debit: 0.35%

- Personal Credit: 0.65%

- Business Debit: 1.75%

- Business Credit: 1.80%

Online/Card Not Present:

- Personal Cards: 1.3% + £0.20

- Commercial Cards: 2.9% + £0.20

Additional Fees:

- Authorization: £0.03 per transaction

- Minimum Monthly Service: £15

Real-world example: Processing £10,000 monthly in debit cards? That’s £35 in transaction fees plus the £15 minimum service fee and your chosen terminal rental. Clean, predictable, competitive.

For businesses processing over £4,300 monthly (where transaction fees exceed the £15 minimum), you simply pay the transaction fees—no minimum charge applied.

All NPI terminals are PCI DSS compliant, ensuring your customer payment data stays secure according to payment industry standards.

Beyond Payments: Services That Drive Growth

Payment Loyalty (£16.99/month)

Integrated loyalty rewards through your terminal—no apps, no punch cards, no friction. Customers pay with their card and automatically earn rewards.

Two types: Nominate Loyalty (perfect for coffee shops—buy 9, get 10th free) and Win Loyalty (gamification for restaurants—instant rewards with payment).

Results: 70-90% customer participation compared to 10-20% for traditional loyalty programs. Measurable increase in visit frequency and spending. According to business growth research, customer retention strategies like loyalty programmes significantly boost small business revenue.

Gift Cards (from £11.50/month)

Customizable branded gift cards with your logo and colors. Real-time management portal tracks activations and redemptions. Works across multiple locations seamlessly.

Starter pack FREE: 20 cards + 1-tier display stand included. Upgrade options available (100-400 cards with multi-tier stands).

Why it works: Gift cards are guaranteed future revenue. Customers typically spend 20-30% more than the card value. Some cards never get redeemed—pure profit.

Terminal Care (£4.99/month)

Life happens. Terminals get dropped, spills occur. Terminal Care provides 24-hour replacement guarantee with 7-day support including bank holidays. Nationwide coverage through strategically located depots.

Value: £4.99/month beats the £200+ terminal replacement cost and revenue loss from downtime. Real customer service—no bots or endless hold music.

Virtual Terminal & Online Gateway

Process payments over phone or email—perfect for taking deposits, processing phone orders, accepting advance bookings, or remote consultations.

Browser and mobile app access, one-off and recurring payments, payment links via email/SMS, digital receipts. Same competitive online rates (1.3% + £0.20 for personal cards).

EPOS Systems (from £30/month)

When you’re ready to scale, NPI offers complete point-of-sale solutions:

- WelcomePOS (£30/month): Hospitality-focused with table management, kitchen displays, delivery integration

- StorePOS/CarePOS (£40/month): Retail and services with inventory, appointments, CRM

- FlexePOS (£15.50-£40/month): Tiered bronze/silver/gold options that grow with you

What Customers Say

“Very happy with my new card machine so far. It looks great and is easy to use. The fees seemed to be very competitive and I’m happy to be supporting a local UK company.” – Padraig Walshe

“Their machine is flawless and works every time. Compared to the SumUp which I have been using for many years up to now, NPI are in a league of their own. A card machine is only as good as the support behind it.” – Brian O’Sullivan

“From start to finish the process for getting my new card machine and account set up was so smooth. The rates are very competitive to the market, saving me at least 50% off my monthly bill.” – Chris Spann

Is NPI the Right Card Machine UK Provider for You?

Choose NPI if you:

- Process £3,000+ monthly in card payments (where the rates truly make sense)

- Value local support available 7 days/week until late evening

- Want transparent pricing with no hidden fees or surprise charges

- Need growth-focused features like loyalty programmes or gift cards

- Appreciate solutions that scale—from single terminal to multi-location EPOS

- Want world-class technology with personalized service

Look elsewhere if you:

- Process under £1,000/month (very low volume may not justify monthly fees)

- Want absolute zero monthly fees as a priority (occasional sellers at craft fairs)

- Need highly specialized international or currency features

- Prefer completely DIY setup with no human interaction

The key difference: NPI isn’t competing on being the absolute cheapest for everyone. They’re competing on being the best value for established UK businesses that need reliable technology backed by real support.

For more guidance on accepting payments, visit the UK Government’s business payment advice for additional resources.

Your Next Steps

1. Calculate Costs: Review your monthly card volume and calculate real costs with NPI’s transparent rates.

2. Choose Your Terminal: Match your business type to the right solution—mobile, countertop, or all-in-one.

3. Consider Add-Ons: Will loyalty programmes or gift cards boost your revenue? They often pay for themselves.

4. Get Your Quote:

- Call: 01-4475299 (Option 1) – Mon-Fri, 9am-5:30pm

- Online: Visit npi.uk

5. Test Support: Call technical support (01-6869428) with questions. Experience the service difference.

The Bottom Line: Your Card Machine UK Decision

The best card machine UK businesses choose isn’t just about features—it’s about finding a partner who grows with you.

NPI combines world-class payment technology with genuinely local support. They’re not the cheapest for everyone, but they deliver exceptional value for serious UK businesses ready to scale.

Whether you choose the portable S1 MINI2, the versatile PAX A920PRO, or the customer-facing KIOSK K2, you’re getting more than hardware—you’re getting a partnership built on transparency, reliability, and growth.

In 2026’s competitive landscape, that partnership is priceless. The Federation of Small Businesses consistently highlights payment processing as a critical infrastructure decision for growing enterprises.

Ready to explore NPI for your business? Visit npi.uk or call 01-4475299 for a personalized consultation.

Pricing accurate as of February 2026. Contact NPI directly for current rates and custom quotes.